How can I start?

You can get the ball rolling with the “Join Today” button in the top menu. That button will connect you directly with our staff, and kickstart any curiosities you may have. If you have a general question, feel free to fill out the form at the bottom of this page!

When can I start?

In most cases, your NMLS license number is tranferred and you are ready to work in 2-3 business days.

What are the requirements to join Northern as a Branch Manager?

- Minimum 2 years documented experience

- Past 2 years’ W2’s

- No felony convictions

- Physical Office Location

Do we offer marketing support?

Yes, we do. Just let us know what you need! We offer a large range of video, photo, and graphics creation.

Do I pay my employees?

Northern Mortgage will handle the payroll for all of your employees. We have a backoffice website that will track hours, commission, etc.; we take care of all things payroll, as long as you monitor your own employees for accuracy.

When do I get paid?

Northern Mortgage processes Payroll every other week, with payday on its respective Friday.

How do I pay branch expenses?

All expenses will be payed by Northern Mortgage’s accounting team with your branch’s operations account.

What benefits are offered?

We offer health insurance through Blue Cross, plus 401k plans, life insurance, short/long term disability, dental, and vision.

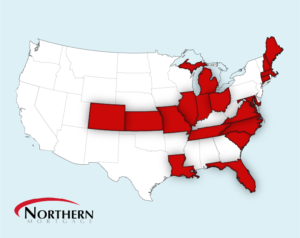

What States can I originate in?

Once approved, loans may be originated in your home state, and any other state Northern Mortgage holds a license in. Currently, Northern Mortgage is licensed in Michigan, Ohio, Florida, Indiana, Illinois, Missouri, Kansas, Colorado, Virginia, Lousiana, Massachusetts, Connecticut, New Hampshire, Maine, Maryland, and Tennesee. We are rapidly expanding!

What loan programs does Northern offer?

We are able to underwrite and fund FHA, USDA, VA, Reverse, and Conventional loans.

What resources does Northern regularly utilize?

We use the Encompass software by Ellie Mae to process the main workflow of our loans. We also have an ever-improving online resource website for all employees and branches to utilize.

Who controls the compliance on my loans?

Northern Mortgage expects the Loan Officer to handle compliance, but Northern offers resources to aid in that process. Regardless, our corporate office will examine each loan for complete accuracy.